As the COVID-19 pandemic has spread, closing businesses and forcing consumers indoors, economies across the globe have been hit hard by the sharp reduction in consumer spending and productivity. With manufacturing centers around the globe at a standstill, supply chains have been disrupted on a level not seen since the Second World War.

The result is that financial markets have been massively affected, leading to a crisis that in some ways mirrors and in other ways surpasses those that followed the 2008 financial crash and the September 11 attacks. Even with massive government bailouts and stimulus efforts, brands and financial institutions are bracing for a long-term period of economic depression.

-

Interests in financial products have shifted

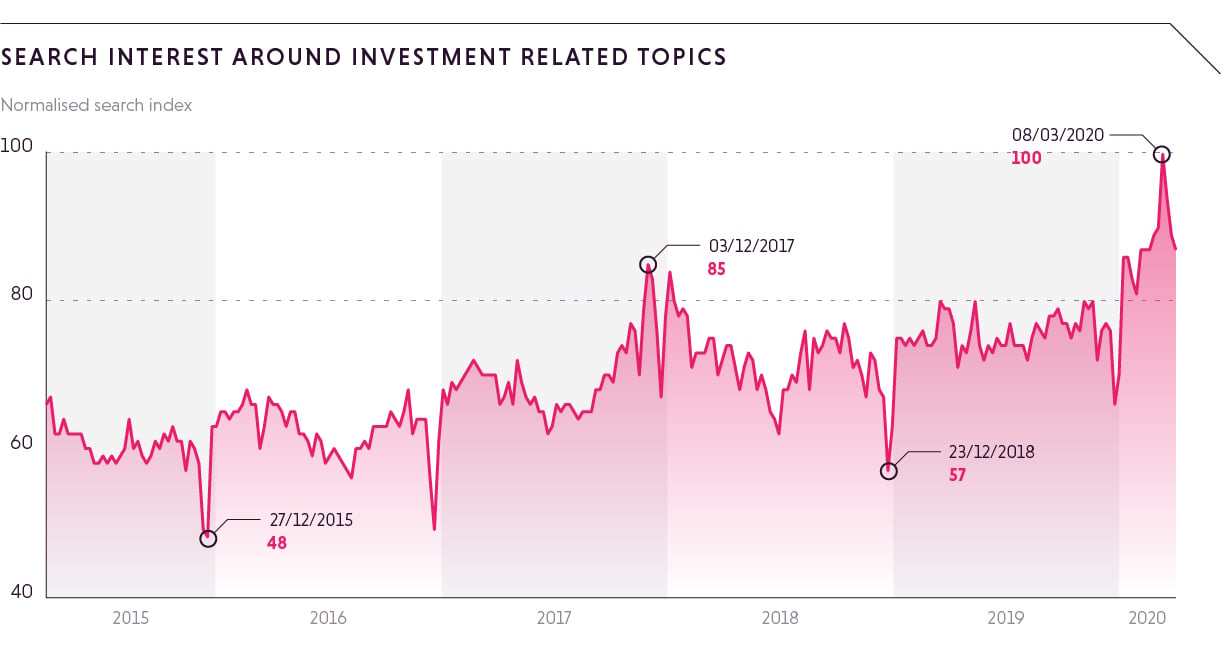

Interest in online news and information around finance and investment-related topics has hit a five-year high, increasing by more than 27% year-over-year worldwide, and up 21% from February to March.

People are hungry for news about the crisis and its impact on the markets, and are looking to educate themselves on how to protect their long-term financial outlook. Interest in mortgages and retirement savings have seen the largest increase since the start of the quarantine period.

2. People are doing more of their banking during the workday

People tend to be heading online to research and learn about personal finance tools during the day, particularly between the hours of 1pm and 4pm, though interest is generally up - 69% across the board.

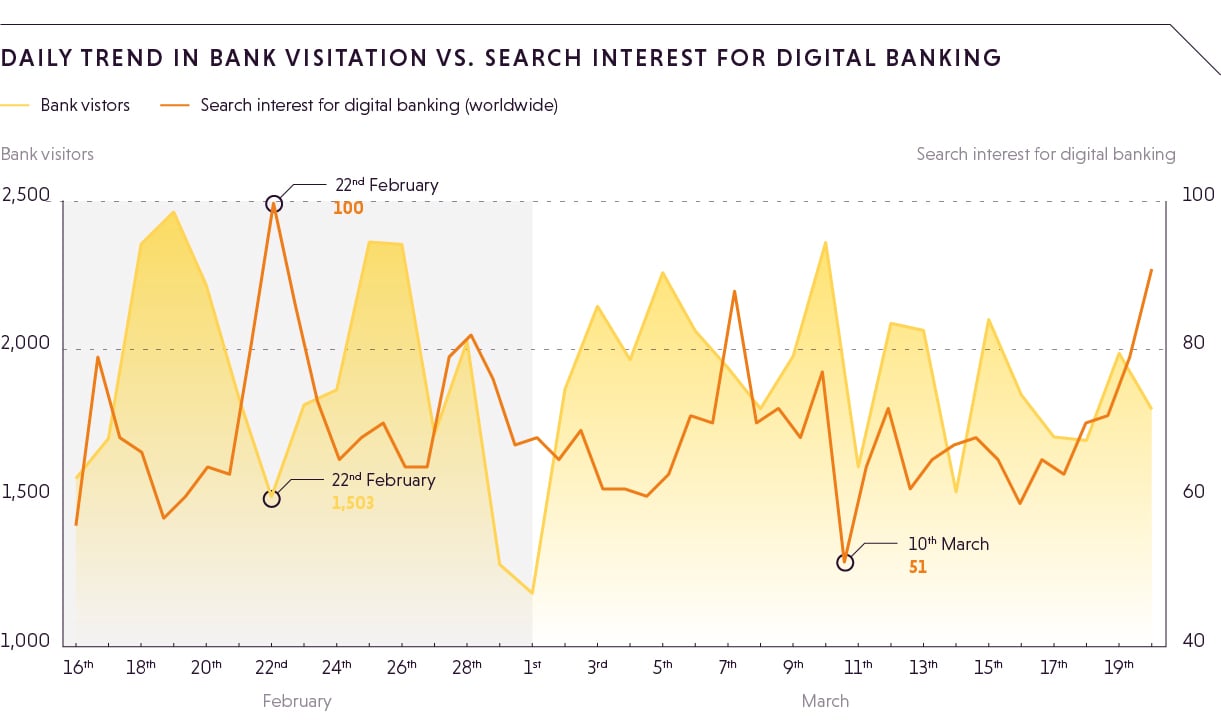

3. With trips to the bank out, people are looking to online banking

As consumers have been forced inside and the WHO has advised consumers to move to more digital transactions, interaction with online banking has increased. Digital wallet platforms like Paypal, GooglePay, and WePay are seeing increased interest, particularly in the countries hit hardest by the epidemic.

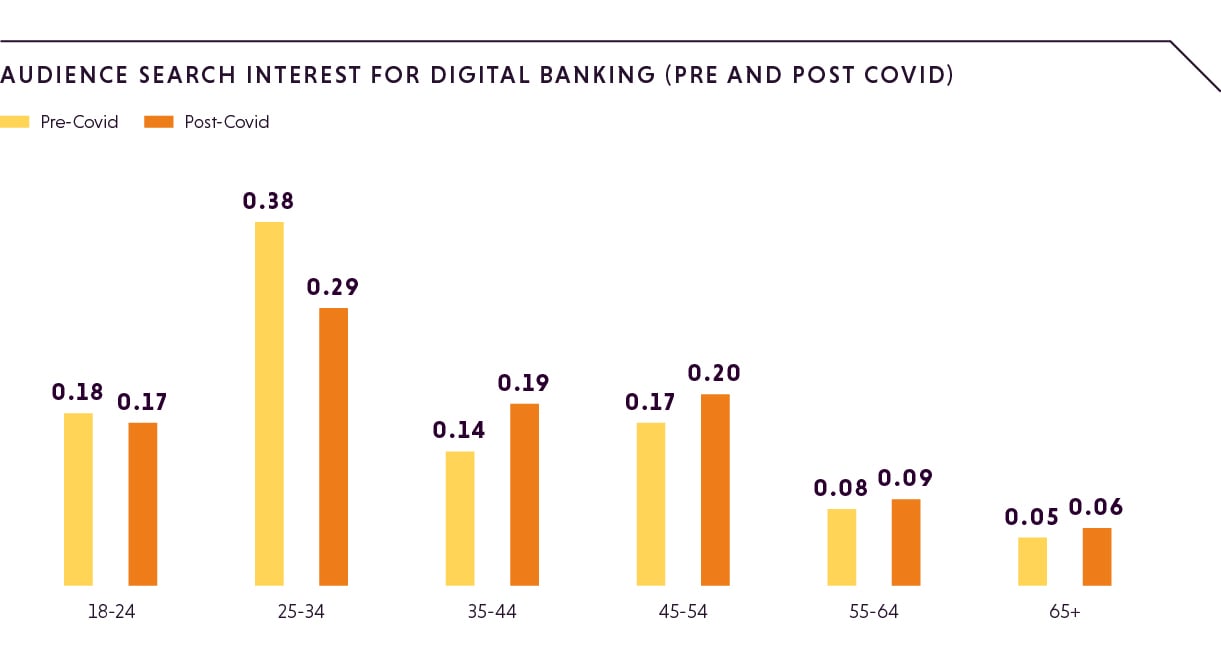

Since March 15th, general interest for digital banking has increased significantly among older consumers, particularly among those ages 55+. Similarly, online queries around pensions and retirement accounts have increased by almost 13x over the last three weeks.

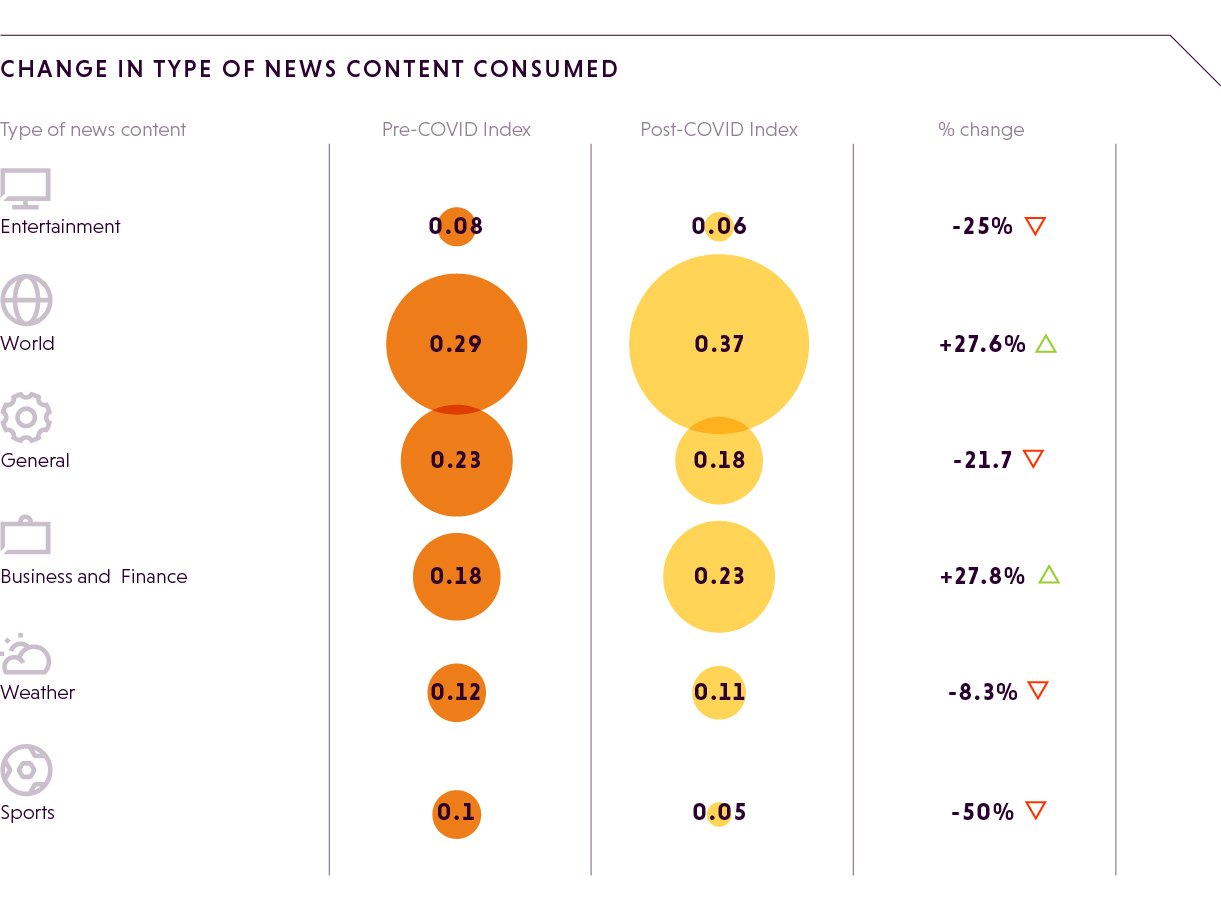

4. Consumers are hungrier than ever for financial news

Finance and business news have seen the largest increases in the type of news content people are engaging with since the outbreak, outside of world news. The majority of viewers (62%) are between the ages of 25 and 45 with an annual household income of more than $75k/£60k.

5. People still prefer to read mobile news on mobile devices

Most engagement - more than 60% - with financial news and content happens on a mobile device, with PCs and laptops being a distant second. This hasn’t changed much as a result of the pandemic.

.jpg?width=940&name=devices%20(1).jpg)

For financial advertisers, rough times are likely ahead, as consumer uncertainty increases and more people find themselves thinking about what will happen to their savings.

If you want insights like these delivered straight to your inbox, subscribe to our insights mailing list.

Listen to the Insights Track podcast on Spotify or Soundcloud.