With an audience of over 2.5 billion fans spread across 180 countries, cricket is the second-most popular sport in the world after football, and the world cup its biggest stage. As with every other major sporting event, we couldn’t help but think about who the fans are and what it means for advertisers.

Cricket’s growing reach

Cricket is most popular in Australia, England, and subcontinental Asia, and migration patterns over the last few decades have helped to spread the sport’s popularity worldwide. As the sport has increased in popularity in the West, marketers in America and Europe have begun to look at cricket for opportunities to reach Asian audiences who are otherwise difficult to engage with.

Since 2000, Asian Americans’ buying power has grown by more than 250%, up to $986bn. As a result, Asian Americans have become leaders in technology consumption, purchasing, and usage, and over-index to ownership of most tech devices. They’re active online shoppers, and they spend more annually than the average US household, both online and offline.

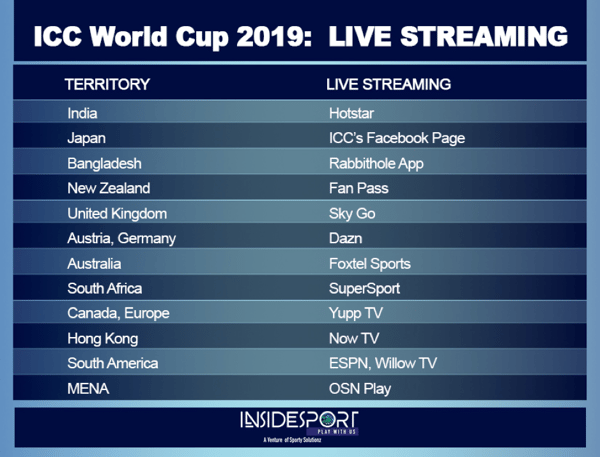

As OTT services have exploded, so have those catering to specific national and linguistic interests. Launched in February 2014, the Disney-owned Indian OTT service Hotstar set new records for viewership with the 2019 Indian Premier League, with 18.6m concurrent viewers during the final match. The service expanded to the United States and Canada in 2017 and the United Kingdom in 2018, and currently has streaming rights for the 2019 Cricket World Cup in India. Yupp TV is handling streaming rights for the US, Canada, and much of Europe, Foxtel Sports is handling Australian streaming, and Sky Go is where UK viewers will go to stream the series.

Engagement with the game

As the 2019 World Cup kicked off, search interest for cricket increased 37%, while interest in fantasy cricket increased 28% at the same time. During the tournament, sessions and page views for sites and apps that offer live updates on matches will increase by 6x while games are on, and the average fan will visit the content two to three times during the match to get live commentary and view scores.

Interest for specific teams varies wildly by team and region. India, a favourite in this year’s contest along with England, is a particularly big draw. Matches featuring the Indian team will generate almost three times as many impression opportunities as other teams regardless of the strength of their opponent. Likewise, the English team generates a healthy amount of buzz as well - social activity created during England’s matches is more than double the average for smaller teams.

-2.png?width=600&name=image%20(3)-2.png)

.png?width=600&name=image%20(4).png)

When it comes to finding cricket content, four out of 10 searches for World Cup-related content happens on a mobile device, though this varies by region. Mobile activity peaks for fans in the US and Canada, among whom 70% will use mobile devices to find content. Meanwhile, Australian and New Zealand fans primarily use their PCs or laptops to search for relevant content.

-3.png?width=600&name=image%20(2)-3.png)

Targeting the cricket audience

Though cricket fans can be found in many countries, how they engage with the game varies by their geography, creating differences that marketers need to be aware of.

In the United States and Canada, the cricket audience tends to be between the ages of 35 and 53, skews heavily male, and includes a significant portion of the continent’s growing Indian population. Six out of ten cricket fans are employed in either financial or technological services and two thirds (68%) live in urban areas and have a household income over $125k. Apart from cricket, these fans are also likely to demonstrate an interest in soccer, tennis and basketball.

In contrast, Europe’s online cricket audiences tend to be younger, under 35 years in age, and with a more even ratio of men to women. They also come from a broad swath of income groups: 21% have an annual household income over 100k GBP, while 19% have an annual income under 30k GBP. This is reflected in their employment splits, where fans come from a broad swath of backgrounds and professions.

It is much more difficult to classify cricket fans in Asia and Australia due to the immense popularity of the sport in those regions. Cricket fans in these areas come from all age groups, genders, and income brackets, making the sport’s popularity more akin to say, football in Europe. They are, however, more likely to travel. Seven of 10 cricket fans in this region will frequently visit sites about travel and food.