The unprecedented spread of COVID-19 is causing changes in the way people live, the way they shop and the way they interact online. And those changes are happening quickly.

We want to keep you as up-to-date as possible with what’s going on - the insights we’re seeing across the world, the new trends in consumer behavior, and the lessons advertisers and marketers need to learn at lightning speed - so you can stay informed, adapt your plans, and respond to what’s happening in your market.

That’s what our new weekly podcast is all about. Listen to episode 1 of Insights Track to hear from Will Green, Senior Content Strategist and Robert Jones, VP Research and Insight, to get a view of what’s happened in the first two weeks of the coronavirus crisis, and the trends we’re going to be monitoring in the weeks ahead.

Listen to the Insights Track podcast on Spotify or Soundcloud.

Digital Consumption is Increasing Globally

With consumers in many countries being asked to practice social distance or shelter in place, we’ve seen an increase in digital content consumption worldwide.

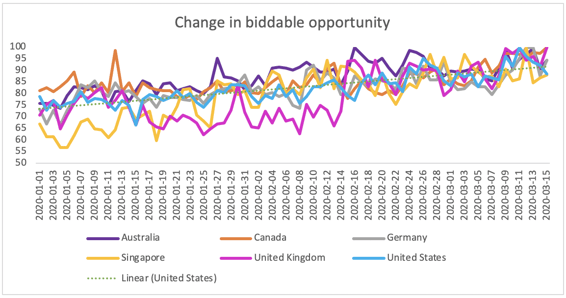

- Digital content consumption - and as a result, ad opportunities - have increased globally.Although we’ve moved into Spring through the month of March, digital consumption continues to increase in the United States, UK, Canada, and other regions globally.

- Increases in digital content consumption have been particularly large in the UK, moreso than any other country in our analysis, where average daily display opportunities grew by nearly 18%.

- Digital content consumption in Canada increased by 12% in March, following a trend observed in the UK and preceding that of the United States.

- Digital content consumption in the United States increased 7%, though the growth curve for US content consumption is significantly steeper, pointing to additional future growth as the scale of the emergency ramps up in-line with the situation in the UK and Canada. Since Coronavirus was declared a national emergency in the U.S., content consumption has increased by nearly 2% day-over-day, adding nearly 30 million display opportunities every day since.

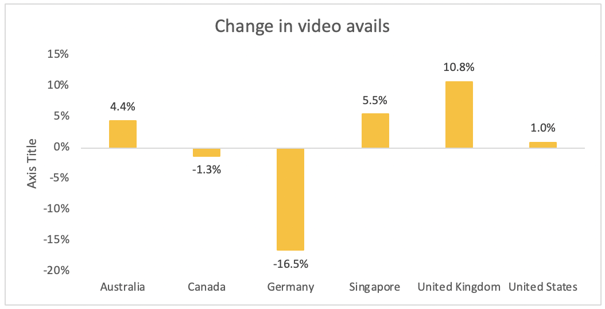

Video content consumption has also increased in every country we measured save Germany, with the majority of new opportunities being generated by desktop and laptop devices, while mobile and tablet video consumption has remained steady or decreased.

% change in video consumption, by country

Though an increase in the video opportunities might not narrate the entire story. Both the viewability rates and completion rates have gone down overall over the course of the last month indicating that not all video inventories are likely to provide advertisers the same advantages as compared to the others. In Germany, Australia and the US the viewability rates have actually increased while in the other regions, an increase in inventory has corresponded with decrease in the overall viewability of the video impressions.

Increased Consumption Doesn’t Mean Increased Demand

Despite the increase in content consumption, we haven’t seen an increase in demand to compensate, leading to a decrease in CPMs overall. This makes sense, given how marketers have been adjusting spend and re-thinking targeting strategies. For those looking to cut spend while maintaining impression totals, the opportunities are there, particularly in video and OTT.

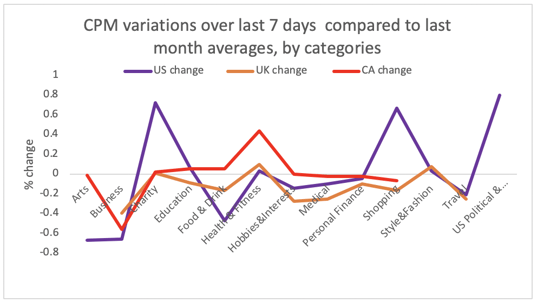

Additionally, not all of this inventory is created equal: Many of the new opportunities being created are around content related to Business & Industry news and Health & Wellness content, two categories that have very high likelihood of showcasing content next to content about COVID-19 and its effects. For many brands, this is less than ideal, and potentially considered “not brand-safe” inventory, while for others it may be an opportunity. The need for whitelists and content parsing have never been greater for brands.

WOW change in the different type of content consumed online

The result is that that inventory costs for finance/business news, and health content have dropped the most, while inventory costs for sites related to charities/giving, online shopping, and political content have increased the most, where demand has continued to increase despite changes in supply.

Likewise, the increase in video opportunities doesn’t tell the whole story, either. As opportunities have increased, viewability and completion rates have gone down in many regions, showing that not all of the new inventory is likely to be valuable to advertisers.

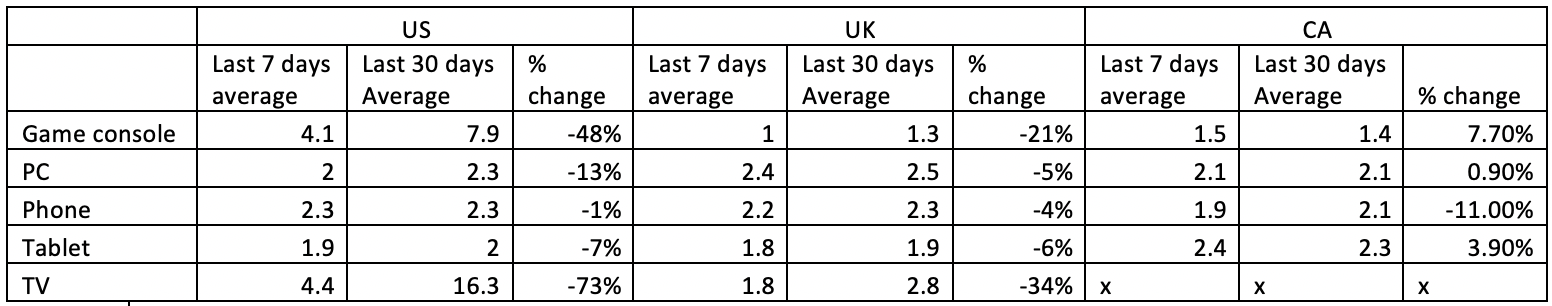

US OTT and TV Consumption Trends

With social distancing in place and schools and business closed, many people are working from home and spending more time with TV and OTT content.

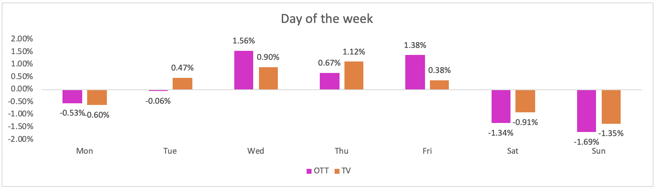

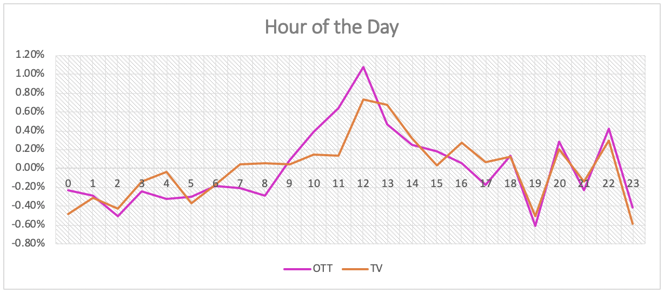

One of the clearest impacts is that people are watching more TV and OTT content during the week, and during the day itself, where we’ve seen significant increases in viewing during non-prime hours.

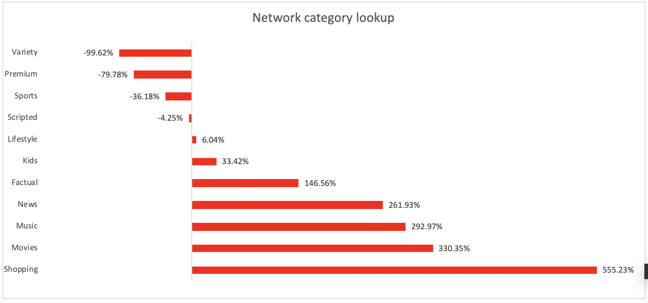

And naturally, as sports leagues have suspended their seasons, viewing habits have shifted away from sports content and harder towards news content on linear TV, where the need to stay up-to-date has been strong.

For advertisers, there’s a lot to consider as things change and uncertainty looms. Inevitably, consumer habits will change. In some cases, this will be temporary but in others the changes will be permanent. The brands that can quickly work out which is which, and who respond the best will be those that are able to survive and be best-positioned to recover.

If you want insights like these delivered straight to your inbox, subscribe to our insights mailing list.