By: Jim Davis, Senior Director Revenue, MiQ Digital, Canada

If you have any questions about MiQ’s cannabis solutions, please contact Jim Davis (jim@miqdigital.com) or visit our content hub (link).

The Canadian cannabis industry has always been a bit of a Wild West for marketers. Compared to other, long-standing verticals, it’s brand new, and cannabis marketers - like consumers, businesses and legislators - are still working out how it all works best.

While the COVID-19 pandemic has been almost universally disruptive, it’s a disruption that has been felt especially by a nascent cannabis industry still finding its feet.

At a topline level, there’s good news and bad news. Demand is still steady for cannabis products as consumers look to recreational cannabis as a means for alleviating social isolation. On the other hand, supply chains have been impacted - sometimes severely - which can increase costs and generally worsen the customer experience.

But the most interesting thing, for marketers, at least, isn’t the good and the bad. It’s what’s changed. How has COVID-19 changed the way consumers research and buy cannabis products? And, more importantly, which of those changes are likely to outlast lockdown?

What changed post-lockdown?

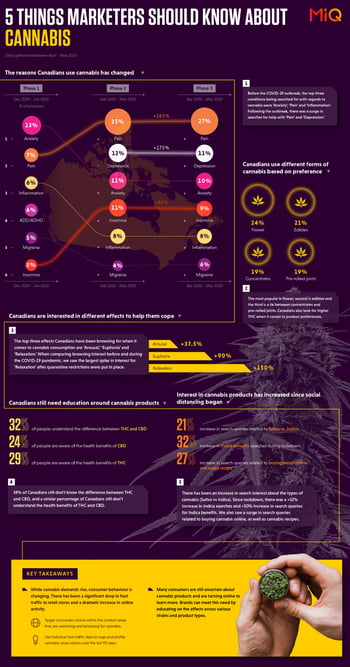

We looked at data comparing online browsing behaviour in February (pre-lockdown) and May (post-lockdown). It’s notable that, along with categories like health, cannabis-specific content saw a spike in consumer interest (+25%), at the expense of categories like travel (-67%) and entertainment (-38%). This is important for a few reasons. Prior to the COVID-19 outbreak, we found a

general lack of awareness among Canadians of cannabis and cannabis products. The majority of Canadians, for instance, don’t know the difference between THC and CBD components, nor are they clear with the benefits. With more consumers searching for cannabis information online, this creates an opportunity for brands to focus more on education as part of their marketing.

And there’s a long-term factor to this too. Research shows that in times of economic downturn, cannabis consumption increases. While nothing is certain, a prolonged economic downturn seems likely and that changes the way consumers buy too, as they look for the most cost-effective way to get the products they want. Consumers might move away from the brands which are perceived as high-end or more luxury, in favour of cheaper product offerings. There are already signs that people are looking to bulk-buy cannabis products, both to make sure they don’t run out and to benefit from economies of scale.

If there is a prolonged lockdown or a drawn-out economic downturn, the way people buy cannabis now might become the established way they do it in the future.

How have behaviours around cannabis changed?

The outbreak of the COVID-19 pandemic has undoubtedly changed the reasons why people are looking for cannabis products. Before the outbreak, the top three conditions being searched for on cannabis websites such as Leafly.ca were anxiety (13%), pain (7%) and inflammation (6%). But post-lockdown, there was a surge in people looking for cannabis products that could help in dealing with pain (27%) and depression (11%).

The effects people were looking to get from the products changed too. Prior to the outbreak, the top three effects being searched for were arousal (16%), giggly (12%) and euphoric (11%). Post-lockdown, there were big increases for arousal (up to 22%) and euphoria (up to 21%), but it’s notable that ‘relaxed’ (14%) became the third category, having previously not been featured as a top effect.

Clearly, at a time of widespread social, economic and medical anxiety, people are looking to cannabis products as a means of combating this anxiety, either through distraction or suppression.

This is important information for cannabis marketers. Not only to make sure they’re giving curious consumers the right information about the right effects and marketing accordingly, but also so they can be more aware of their overall corporate social responsibility. Knowing that their audience is suffering pain or symptoms of depression is a huge opportunity for brands to be genuinely empathetic, offering advice and information that goes beyond selling their product to help consumers deal with their situation.

What should cannabis marketers be doing?

Before COVID-19, the offline world was a huge part of cannabis marketing. Consumers, perhaps wary of buying previously-illegal products online, still preferred to do most of their buying in physical locations, even though their research was online. Activations were different too, with significant portions of budget going towards things like celebrity endorsements to ‘normalize’ cannabis products.

But the outbreak has changed that. With in-store buying made more difficult, or even impossible, consumers are forced to complete their entire buying journey online. If they get a good customer experience using online, that’s a behaviour that’s likely to stick.

Likewise, as marketing budgets tighten (in all industries, not just cannabis), the kind of measurable, ROI-driven marketing activation that programmatic offers will become more attractive to CMOs and senior marketers.

To make the most of this, it all comes back to data. Post-COVID, it’s more important than ever that marketers understand who their audience is, why they’re looking for cannabis products, and how they buy.

Data partnerships with partners like Environics Analytics and Unacast will allow you to identify and qualify your target audience, seeing things like who bought from you in the last 90 days and where they live at a postal code level. Combine this with digital behavioural data gathered from first and third parties, and you’ll be able to build powerful audience segments, which you can use to tailor messaging to drive conversions, as well as maximize reach by activating things like lookalike retargeting.

Like most other industries, cannabis marketing and advertising has been profoundly impacted by COVID-19. But, because cannabis marketing is still a relatively new discipline, the effects of the pandemic and the huge increases in digital audience has brought a great opportunity for marketers to connect all the data available to them, and build audience relationships that last long into the ‘new normal’.

Check out MiQ's cannabis offering and solutions here

More about Jim:

Jim Davis is a media and marketing leader with an extensive background in the advertising and technology industry. He is widely recognized for his expertise and passion, regularly speaking at Canadian events on transformational trends and emerging technologies.

As cannabis industry lead, Jim oversees key relationships with a number of strategic partners, driving the design and development of MiQ’s proprietary analytics platforms and media solutions. Jim has 20 years of digital media experience in the Canadian market, previously working at companies such as; Yahoo Canada, Snap Inc. and Torstar Digital.