Meal kit delivery services are also seeing a major surge in interest. Online grocers such as Kroger, Amazon pantry, Publix or traditional providers like Walmart, Tesco and D2C meal prep brands like HelloFresh and BlueApron are all witnessing a considerable increase in demand and order frequency.

People are ordering more online, but staying close to home

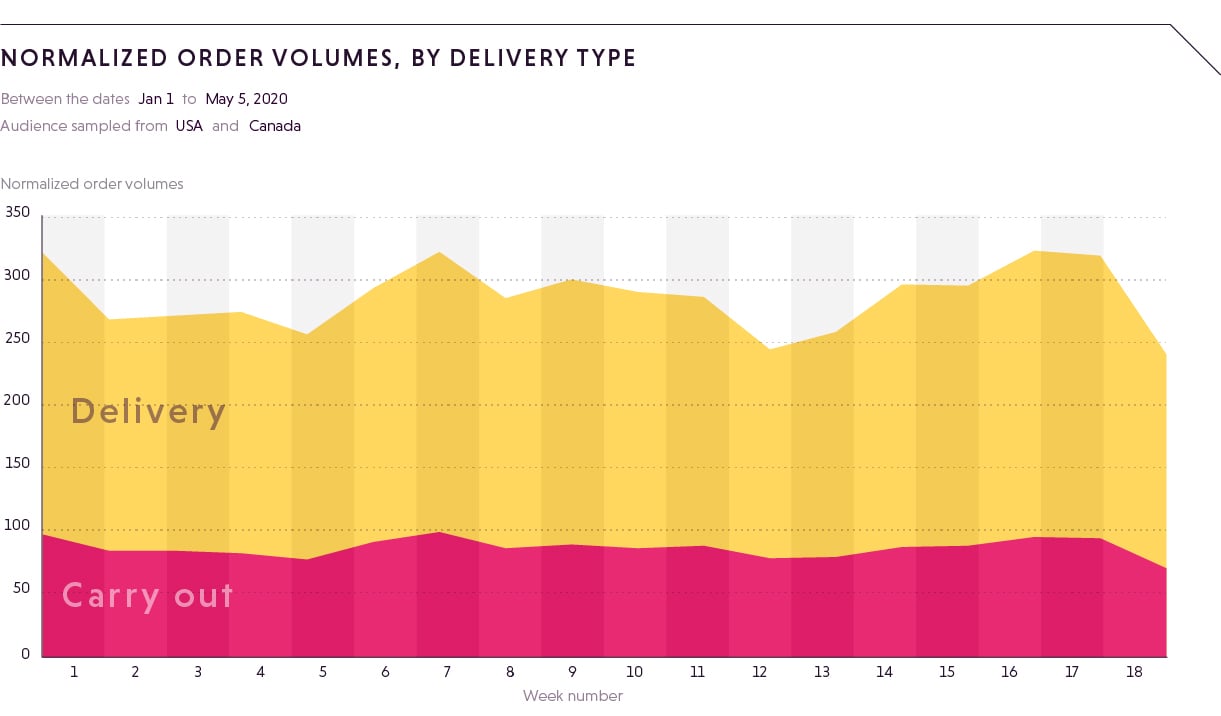

Restaurant foot traffic and online reservations may have dropped to zero, but in the US, UK, and Canada online orders for pickup and delivery are booming, with steady increases over the past 45 days, particularly for casual dining and quick-serve or fast food restaurants, where site visits and purchases have been increasing. As orders have increased, the share of carry-out versus delivery has remained fairly consistent, though people are traveling shorter distances to visit restaurants to pick up these orders.

.jpg?width=940&name=Change%20in%20online%20food%20ordering%20(1).jpg)

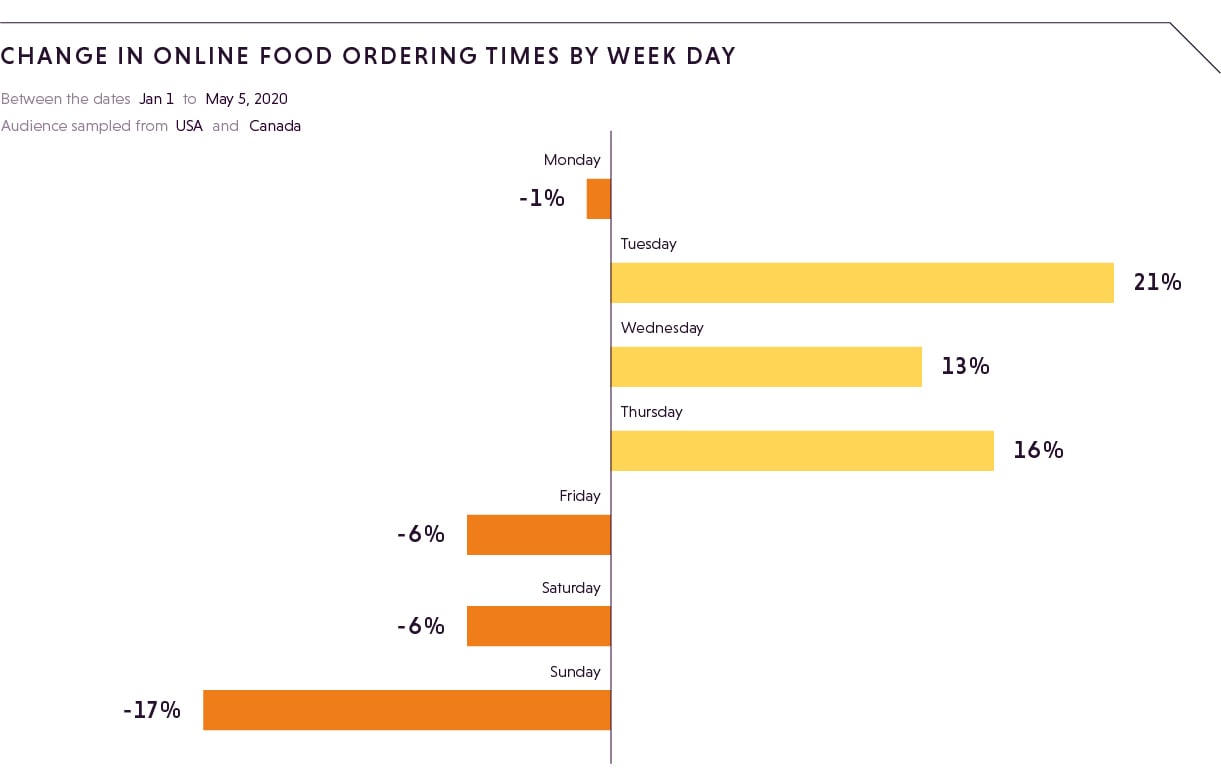

People have changed when they order

Not only are there more orders, but they’re coming at different times. Orders are up by almost 12% on weekdays, with Tuesdays seeing the biggest gains and weekends seeing fewer orders as the notion of a “weekend” loses its meaning. Take-out orders are more common on weekends, while online orders are more likely to happen on weekdays. Time of day is also a major factor - dinner orders are only up 3% (and late night orders down 11%), while lunch orders have increased 18%.

New customers order more

People are taking the opportunity to discover new restaurants and order delivery or take-out from restaurants that previously weren’t part of their regular rotations. When these new customers place an order, they order 8% more than average, and tend towards higher-value items. Globally, people in the US, UK, and Canada are 1.3x more likely to order from a new restaurant on a weekend than a weekday.

People are spending more time weighing options

People are spending more time looking at different restaurant options before placing an order, going through 1.7x more sessions before adding an item to their basket and spending 31% more time per session. The majority of orders (63%) are made on phones, and phone orders are more likely to happen on weekends.

Age is a factor in how the orders are placed as well. Younger consumers are more likely to opt for take-out or curbside pickup, while older consumers, especially those with kids, are more likely to order in. Ordering in was also more common in areas more heavily hit by the virus.

Visiting restaurants

With social distancing in place, when people visit restaurants in-person, it’s typically to pick up an order made online or order take-out. But despite many restaurants allowing pick-up and take-out options, the total number of orders has still slowed and people are making fewer visits to these restaurants (and are traveling shorter distances to get to them, as we saw above).

As orders have ramped up, so have wait times, leading consumers to look for options with shorter delivery times. For in-person visits, this means more cross-visitation, particularly when someone can see another, less crowded option nearby.

Foot traffic to fast food and casual dining restaurants has decreased 45% and 67%, respectively, since the start of lockdown efforts.

Different country, same story

We see similar trends across the different regions. Canada still sees higher cross-visitation between different restaurants. In Germany consumers have a clear preference for casual dining, while US consumers prefer fast food.

.jpg?width=940&name=percentage%20change%20in%20foot%20traffic%20by%20country%20and%20restaurant%20type%20(2).jpg)

Restaurants are competing with home cooking

With people spending more time stuck at home and discouraged from going to restaurants, interest in home cooking has skyrocketed. We’ve seen spikes in searches and site traffic that compare in size to those normally seen around the Christmas season, when cooking for loved ones is much more common. But what people are looking for is considerably different.

Compared to the holidays, many lockdown chefs are looking for healthy cooking and simple one-pot meals that require less time and effort, that are also easily repeatable. There is also a significant segment of home chefs looking to invest more time into their cooking skills and experimenting with new baking and barbeque techniques.

.jpg?width=1221&name=percentage%20change%20by%20cooking%20categories%20(2).jpg)

Search interest cooking on weekdays has also been growing steadily during the lockdown with more and more consumers looking to cook a hearty dinner, especially in the UK and the US. Comparatively, Canadian home chefs appear to be more interested in brunch.

.jpg?width=940&name=Engagement%20around%20cooking%20content%20before%20and%20after%20covid%20(1).jpg)

Interest in meal kit services is also on the rise

Younger consumers are driving the bulk of this new interest in cooking. Nearly a third of cooking-related searches in the US and nearly half of searches in the UK come from consumers under the age of 45, particularly those with children under 15 in the household. And as interest in cooking has increased, so has interest in meal kit services. Meal kit interest has increased most significantly among people aged 18-24 in the US and Canada.

.jpg?width=940&name=home%20cooking%20%26%20meal%20kits%20(1).jpg)

Mobile is still a factor

Mobile devices are an important part of the research and order process for groceries, cooking advice, and meal kits. In the UK four out of 10 cooking-related searches occur on a mobile device.

Video is becoming vital to better cooking

YouTube is another important medium home chefs are turning to for help on cooking-related queries, be it for watching cooking videos or getting tips around meal prep. About one third (31%) are also looking for videos by celebrity chefs and fitness experts for tips, spending an average of seven minutes per video/stream.

If you want insights like these delivered straight to your inbox, subscribe to our insights mailing list.